By: Ag. Reporter Mollie Goode

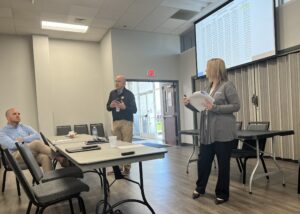

Christian County Public Schools Superintendent Chris Bentzel and Finance Director Jessica Darnell to discuss property taxes at Tuesday’s Christian County Agri-Business Association meeting.

The discussion at the monthly agri-business meeting helped clear up misconceptions and answer questions regarding the district’s revenue. The district’s revenue is determined by two things, the assessed value of your property taxes and how those rates are levied at the local level, along with the Support Education Excellence in Kentucky (SEEK) funding.

Darnell says Christian County currently has the 7th lowest property tax rate in the state, but it has the 11th largest population and is the 2nd largest for geographical area. She adds that the county has a disparity between where the tax rate is and where the population and size fall when compared to other districts.

Bentzel adds that from last year to the current year’s revenues, the district took a $1.3 million deficit because the property appraisal increased and created less opportunity to receive state funding.

Darnell says the SEEK formula requires the district to at least levy a 30 cent property tax rate to qualify for state funding. She says that for every million dollars of property assessed in the district, they will receive $3,000 less in SEEK dollars.

The tax rates are set every August and are a combination of tangible property, motor vehicle, and utility tax bills. Christian County’s 2024-2025 property tax rate is 42.1 cents, its motor vehicle rate is 56.6 cents, and the utility tax rate is 3%.